COMPENSATION DISCUSSION AND ANALYSIS (CD&A)

In theThe CD&A we describedescribes and discussdiscusses our executive compensation program,programs, including its objectives and elements, as well as determinations made by the Compensation and Human Capital (“C&HC”) Committee regarding the compensation of our named executive officersNamed Executive Officers (“NEOs”). Below is a condensed table of contents to help guide you through the CD&A section of this proxy statement:

- Executive Overview (pp 33)- Executive Compensation Decision Making (pp 37)- Our Executive Compensation Program (pp 38)- Executive Compensation Elements (pp 39)- Executive Compensation Process and Guidelines (pp 47)Our Named Executive Officers (NEOs)

As of December 31, 2022,2023, the NEOs are:

| | Lloyd Yates

President and Chief Executive

Officer(“CEO”) | | | Shawn Anderson

Executive Vice President and

Chief Financial Officer (“CFO”) | | | Donald Brown

Executive Vice President and Chief

Innovation Officer and Former CFO | |

| | Melody Bimingham

Executive Vice President and

President, Nisource Utilities | | | William (“Bill”) Jefferson

Executive Vice President, Operations

and Chief Safety Officer | | | Michael Luhrs

Executive Vice President,

Strategy and Risk and

Chief Commercial Officer | |

As a trusted, reliable energy partner, NiSource is committed to putting our shareholders, customers, employees, and the communities we serve at the forefront of everything we do.

Leadership Changes

On March 27, 2023, President and CEO Lloyd Yates —Presidentreconfigured his leadership team with the appointment of Michael Luhrs as Executive Vice President, Strategy and Risk and Chief Commercial Officer who has nearly 25 years of experience in the energy industry. In addition, Melody Birmingham was appointed the Executive Officer (“CEO”)

Donald E. Brown—Vice President and President, NiSource Utilities, Shawn Anderson was appointed the Executive Vice President and Chief Financial Officer, (“CFO”)

Shawn Anderson—Senior Vice President Strategy and Chief Risk Officer

Melody Birmingham—Donald Brown was appointed the Executive Vice President and Chief Innovation OfficerOfficer. We previously announced that Donald Brown is departing the Company effective April 1, 2024. Also, effective April 1, 2024, Bill Jefferson's title is EVP, Chief Operating and Safety Officer.

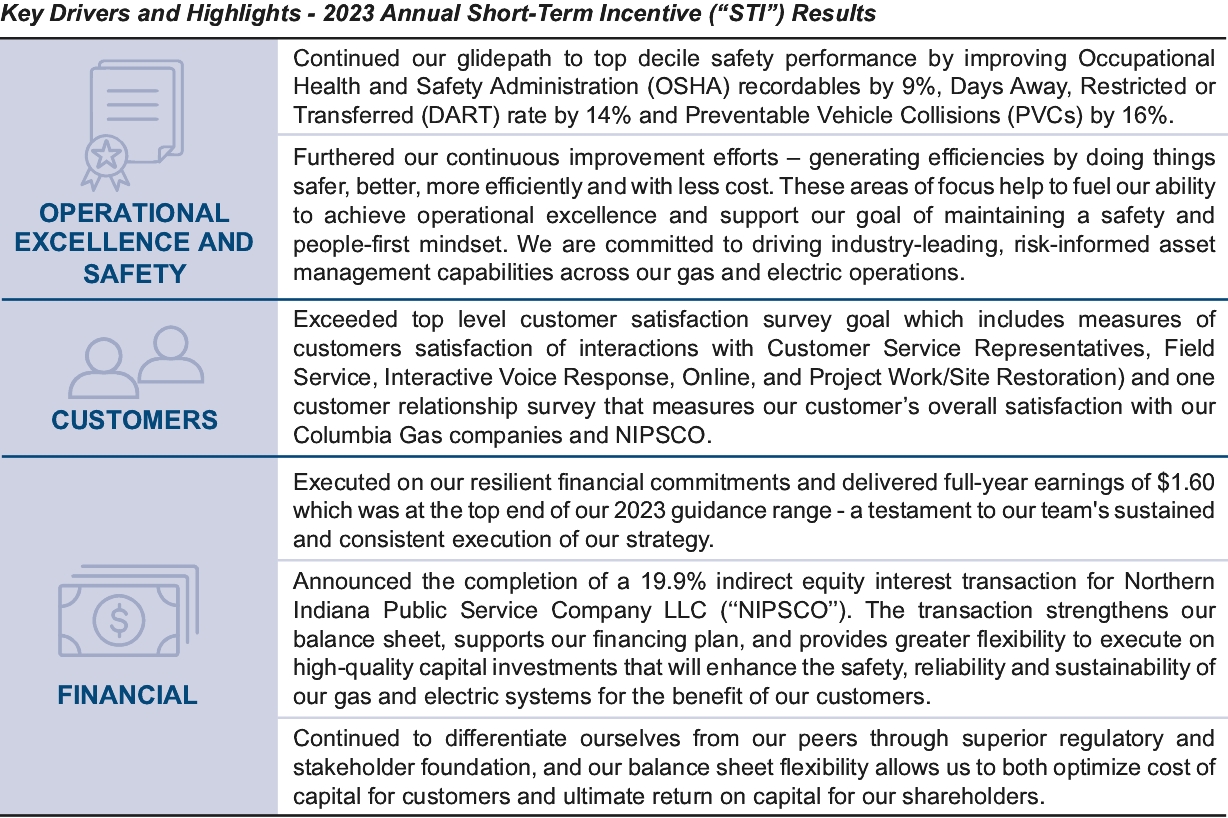

Bill Jefferson—Executive Vice President and Chief Safety OfficerCompany Performance Highlights Impacting Compensation Outcomes for 2023

Joseph Hamrock—Former President and Chief Executive Officer

Pablo A. Vegas—Former Executive Vice President and Group President, Utilities

On March 15, 2023, we announced a reconfiguration of leadership responsibilities for several of the above named NEOs, effective March 27, 2023. Please see our annual report or our website for further details.

Our Company

NiSource is one of the largest fully regulated utility companies in the United States, serving approximately 3.2 million natural gas customers and 500,000 electric customers across six states through its local Columbia Gas and NIPSCO brands. Based in Merrillville, Indiana, NiSource’s approximately 7,500 employees are focused on safely delivering reliable and affordable energy to our customers and the communities we serve.

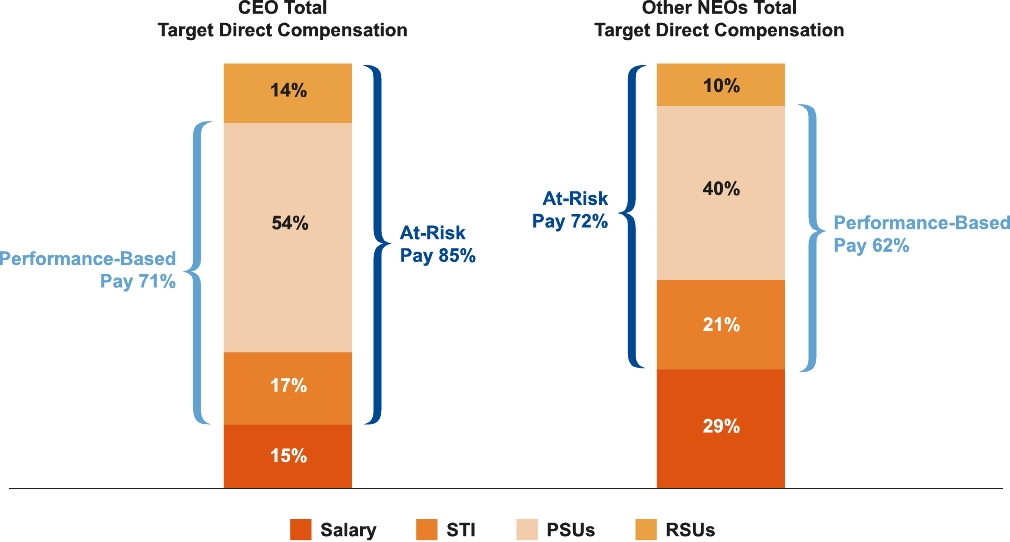

Our strategies focus on improving safety and reliability, enhancing customer service, pursuing regulatory and legislative initiatives to increase accessibility for customers currently not on our gas and electric service, ensuring customer affordability and reducing emissions while generating sustainable returns. With our strategies in mind, NiSource is committed to providing safe and reliable energy for our customers, which in turn creates value for our stockholders. Our executive compensation program is intended to attract and retain the best leadership talent in the industry. At the same time, our compensation program is designed toindustry and align our executivesexecutives’ interests with those of stockholders to achieve these critical commitments.

Leadership Enhancements In 2022

2022 was a year ofour goals and continued transition for NiSource. Following the planned retirement of former CEO and president Joe Hamrock, the company appointed Lloyd Yates as CEO and President, assuming these roles on February 14, 2022. Mr. Hamrock assisted in facilitating the CEO transition in a non-executive officer role and resigned effective July 31, 2022.successes.